- #Quickbooks enterprise 2019 manual how to

- #Quickbooks enterprise 2019 manual install

- #Quickbooks enterprise 2019 manual manual

- #Quickbooks enterprise 2019 manual upgrade

- #Quickbooks enterprise 2019 manual pro

#Quickbooks enterprise 2019 manual manual

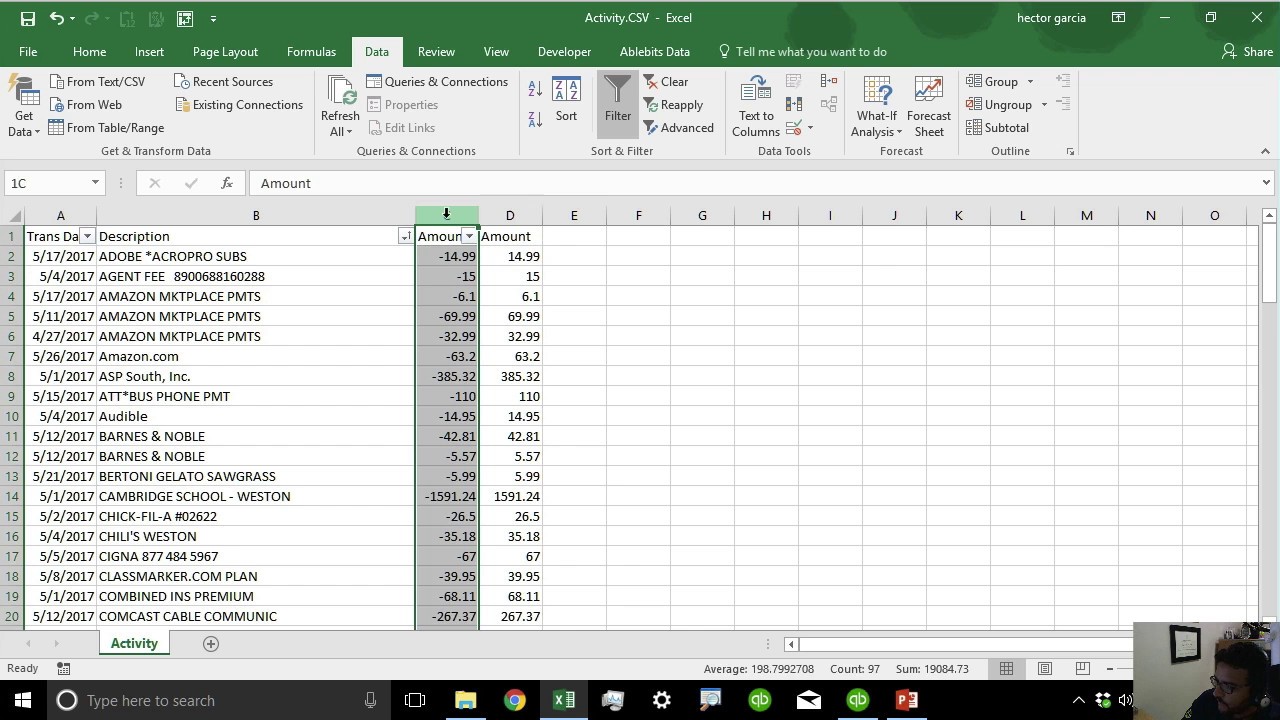

On the dashboard, choose your connection and click Manual Sync. Your total in the Debit column should equal the total in the Credit column, and the journal entry will then be properly balanced. If you use QuickBooks Pro, Premier, or Enterprise, you must run your Web Connector.

#Quickbooks enterprise 2019 manual install

To install and set up Enterprise Solutions, refer to the QuickBooks Enterprise Solutions Installation and Setup Guide.

#Quickbooks enterprise 2019 manual how to

Use this guide to learn how to use QuickBooks Enterprise Solutions and perform essential tasks. Learn from experts and get answers to your QuickBooks. Welcome to QuickBooks Enterprise Solutions financial software. Youll need to sign up for QuickBooks Desktop Payroll if you use the Set my company file to use manual calculations connection and want to restore payroll tax.

#Quickbooks enterprise 2019 manual pro

#Quickbooks enterprise 2019 manual upgrade

We tried to upgrade from 2019 to 2021 last year. Separately, they can choose how their vendor will receive the payment - as a deposit in their bank account (ACH) or as a paper check. To avoid interruptions to your service, purchase and register a supported version of QuickBooks. QuickBooks users can choose to pay their vendor bills by ACH, debit or credit card. Assign a specific day for the payment to be processed and sent.

Optionally, on demand, users can select Sync Online Bill Payments from the menu bar to sync these details with the QuickBooks Company file.įeatures: Users can schedule vendor payments online from within QuickBooks. As the charges are deducted from your funding source, QuickBooks will record the fee bill as paid. Note: If paying a vendor bill with a payment type that includes a separate processing fee, QuickBooks will create a vendor named Melio, and these charges will be added as a vendor bill. Optionally, from a displayed vendor bill, select Schedule Online Payment from the top right of the main ribbon. How to find it: From the menu bar, select Vendors > Pay Bills. However, if the Internet connection in your office. Included with: QuickBooks Desktop Pro Plus, Premier Plus, Accountant Plus 2022 and all editions of Desktop Enterprise 22.0. Intuit, the developer of QuickBooks, issues these updates to fix bugs or provide performance improvements.

0 kommentar(er)

0 kommentar(er)